Could it be worth getting long-term incapacity insurance? Consider getting long-term disability insurance in case you don’t have enough money put aside to help shell out your expenses and residing expenditures for those who ended up to become disabled and couldn’t operate.

For possibly term life or whole life, you can need to post some specifics of yourself to ensure that the insurance provider to determine when you qualify. This is likely to be an in-depth health questionnaire with specifics of your age, health history, family members medical history, surgeries and hobbies.

Michelle can be a guide editor at Forbes Advisor. She has long been a journalist for over 35 years, crafting about insurance for consumers for the last ten years.

And even when you recover from a critical illness like a major organ transplant or cancer, it can take a considerable amount of your time to recover financially and obtain back on target.

The best type of life insurance for you will also rely upon your present-day stage of life. For example, In case you are younger and need a very low-cost policy, term life insurance is likely to be a good option.

A conventional whole life policy could be a good in shape for prime-net-worth people and people who have long-term financial obligations.

Critical illness insurance can offer additional financial aid should a physician diagnose you with a critical illness. Guardian Life is our prime choose for this kind of supplemental insurance because of its variety of policy solutions and insufficient waiting periods for benefits paid.

Companies which provide critical illness insurance could rate plans by using into account several components. Examples consist of your age, relatives healthcare heritage of critical illness, gender, and General health.

Cash value is often a key element of lasting life insurance. This term refers back to the portion of your premium payment that is certainly put aside within an interest-bearing account, in which it little by little accumulates value.

When you purchase a person long-term disability policy, you choose the elimination period, or ready period of time, which is the time concerning when you’re not here able to function and when incapacity payments commence.

It’s much harder to locate a limited-term policy on your personal compared to a long-term disability policy.

Businesses who want to offer their personnel critical illness coverage should investigate Colonial Life Insurance Company and all they have to supply, Particularly considering staff coverage could be guaranteed.

Verywell Health's Is critical illness plan necessary? content material is for informational and educational applications only. Our Web-site will not be meant to become Who should buy an IUL? a substitute for Skilled healthcare guidance, diagnosis, or procedure.

Full read more long-term disability insurance pays you if you can’t perform in the least regardless of the occupation on account of an personal injury or illness. Partial long-term disability pays you should you’re ready to operate but not at your Earlier entire means.

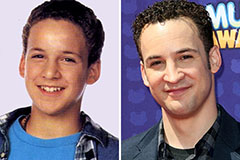

Ben Savage Then & Now!

Ben Savage Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!